Latency, Cloud, and the promise of 5G

If it takes too long, it’s dead to me.

If it takes too long, it’s dead to me.

Latency is the time it takes for a request to return results. There are far more complicated explanations, but it always boils down to speed.

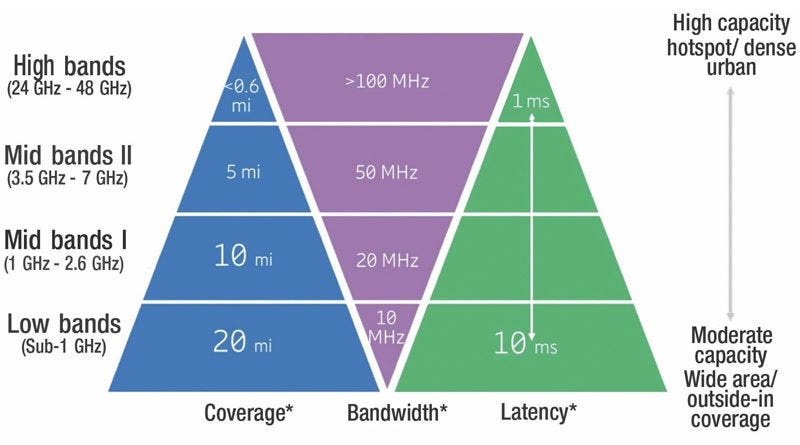

This chart is fantastic for explaining all the elements and how they fit together. Bottom line: More spectrum, with enough bandwidth, closest to the source wins.

This chart demonstrates why new partnerships with Verizon and Enterprise customers are growing. Verizon and Telco’s spectrum so they are the logical partner in this expanding market. The column on the left shows frequency levels. Telcos can’t put 5G everywhere quickly, so they focus on business first. The blue pyramid shows how coverage related to frequency. Faster has worse coverage and penetration into buildings. The 5G standard set’s spectrum and bandwidth specifications to accommodate business only 5G deployments. The middle pyramid in purple shows how bandwidth grows when closer and higher up in spectrum you go. Enterprise installations that can control the first three items to get the best and shortest latency, the green pyramid on the right.

In other words, a business pays more and gets more first. Consumers will be short-changed on coverage experiencing long latency times for quite a few years. Especially the vast open spaces of the USA. The vertical range on the far right of this chart represents coverage by geography. It’s awful if your outside of a major metro where the signal has to travel any distance.

Telco economic priorities.

Enterprise Customers 1–3 years

Cloud partnerships 2–4 years

Dense regions with favorable geography five years

Everyone else 5+ years

So, where does this leave the Cloud companies? Cloud providers are partnering with wireless carriers to incorporate their cloud infrastructure management to be closer to the action. Network points of presence combined with cellular base stations and switching hubs. For example, AWS Wavelength puts AWS storage and compute resources inside a provider’s 5G network to deliver sub-10 millisecond latency to users near what AWS calls a Wavelength zone. The service will be available on Verizon’s 5G network in 2020, but AWS is working with other wireless providers to expand the availability. That does it then. Right?

Nope. The problems are manifold, but one stands out. Who owns the supporting infrastructure and specialized equipment? It’s great to have Cloud providers working on this problem, but it’s all in self-interest. They won’t build anything that does not feed core values. Amazon is already losing money in segments. The model was never designed to be a hub and spoke. It was only a hub.

Enterprise customers have started to migrate out of the Cloud. Look at Dropbox, who saved $75M by taking back control. SME, Small Midsize Enterprise, can’t afford Cloud or the implied risks. It’s a trend that looks to be pushing the technology pendulum the other way again.

Just as de-centralized vs. centralized computing war waged on since the ’70s, so goes the Cloud and enterprise war today. Expect fundamental changes in Enterprise and SME business models. They will likely evolve into hybrids where use cases demand low latency.

5G’s going to revolutionalize the world. Highspeed, low latency, software-defined everything will bring new and exciting business models to market. They will empower more flexible factories and workplaces. No hardwired buildings, no saturated WIFI, less complexity in deployments, and a host of yet to be defined solutions. None of it will come quickly, and few will rip and replace existing infrastructure. Think broadly as to how your Enterprise or SME will deliver services more rapidly inside or outside your organization. Five years might seem far away, but it’s not.